Capital: A new ownership agenda

Image: Jonny Goldstein, CC BY 2.0

Ownership is back on the agenda. Labour’s commitment to taking utilities back into public ownership has reopened questions of governance and control that had been dormant for a generation. But the debate is currently too narrow, focused on specific sectors rather than ownership across the economy more generally. This needs to change. Sharply unequal levels of capital ownership in the UK are a driver of inequality, powerfully shaping the distribution of reward and power in the economy and society. As IPPR’s new report, Capital Gains, argues, to reverse this, we need to build models of common ownership – from the national to the firm level – that give people a stake and a say in our national wealth.

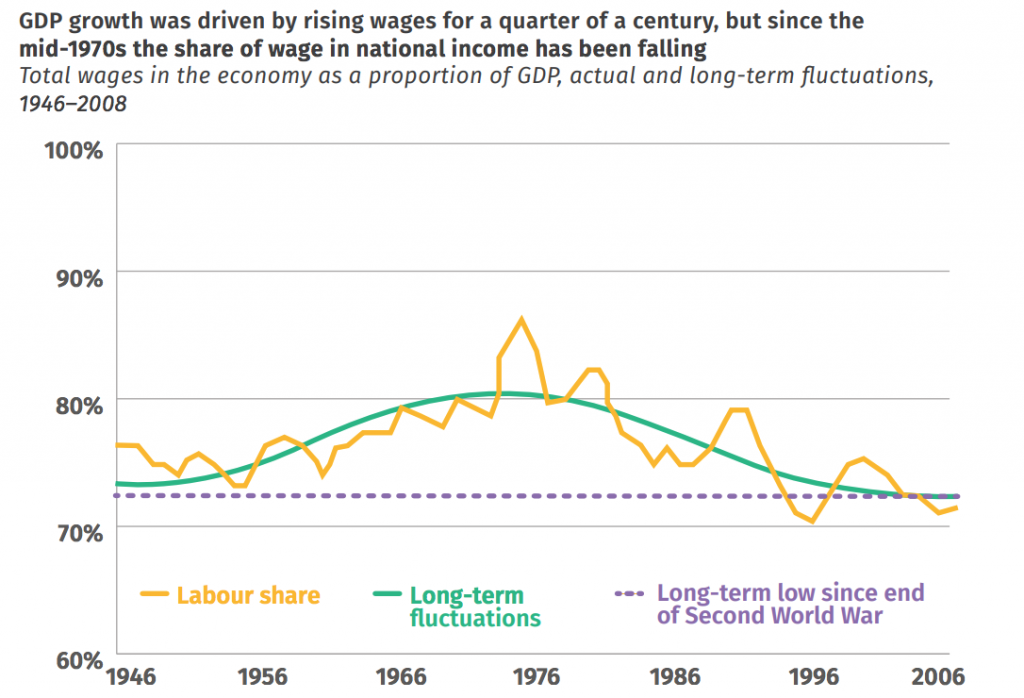

A defining feature of the last 40 years has been the rising share of national income going to the owners of capital in the form of profits, while the share going to labour, in wages and salaries, has declined. This trend has been observed in most advanced economies, driven by a combination of the management of global economic integration and technological change, and their impact on both capital and labour markets, and political choices on the regulation and taxation of labour and capital. A declining labour share reflects a major shift in how economies generate growth and distribute their rewards, with a growing proportion of the gains from growth flowing to capital rather than labour. The economic and political consequences of this transformation are all around us.

Three powerful trends make it likely that capital’s share of national income will continue to rise. First, the value of land continues to increase faster than economic growth, with the value of UK land having grown more than fivefold since 1995. At £5 trillion it now represents more than half of the country’s total net worth (ONS 2017a). Second, growing automation in the economy represents a substitution of capital for labour. If it becomes easier and cheaper to replace human work by increasingly capable robots and artificial intelligence, automation could accentuate existing trends in the capital and labour shares. Finally, the rise of highly profitable digital platform monopolies is also likely to put downward pressure on labour’s share of income. These ‘superstar firms’ aggregate, analyse and monetise ever-growing amounts of data to make supernormal profits, and are set to dominate not just current digital markets but future ones in artificial intelligence and machine learning.

Technological and economic trends therefore risk creating a ‘paradox of plenty’: society will be far richer in aggregate, but for many individuals and communities, technological and economic change could reinforce inequalities of power and reward as the benefits flow disproportionately to the owners of capital.

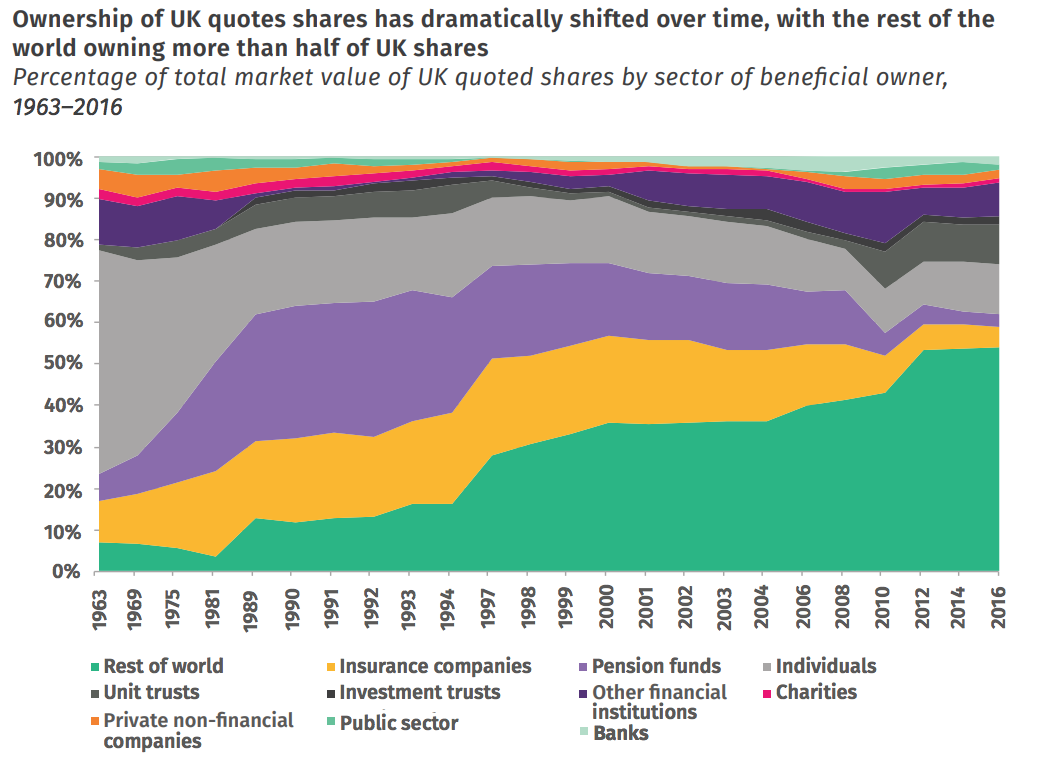

Of course, if capital was broadly owned or democratically governed, the growing share of national income going to capital would not matter for inequality and living standards, since the benefits would be widely distributed. In fact, the ownership of capital is highly unequal. The wealthiest 10 per cent of households own 45 per cent of the nation’s wealth, while the least wealthy half of all households own just 9 per cent. Property, the most widely spread form of wealth, gives people little control over the productive forces of the economy. Financial wealth which does, including stocks and shares, is particularly unequally held: the wealthiest 10 per cent own almost 70 per cent. Indeed, a striking paradox of the ‘shareholder democracy’ revolution of the 1980s was that it led to the concentration, not dispersal, of economic ownership. Ownership of UK quoted shares by individuals and British pension funds has collapsed in the past three decades. Compared to most other advanced economies the UK now scores poorly on economic democracy indexes measuring ownership and economic voice.

Crucially then, given the concentrated and highly unequal distribution of capital ownership in the UK a rising share of national income going to capital has become a major driver of inequality. Moreover, it is a dynamic for growing economic divergence.

Given this, if we are serious about building a different type of economy, where prosperity is underpinned by justice, we need a new ownership agenda. The goal of reform should be two-fold: to give everyone a share of capital, both as useable wealth and for its income returns; and to spread economic power and control in the economy, by expanding the decision rights of employees and the public in the management of companies.

Expanding ownership helps ensure we all have a claim on our common wealth. This matters for more than distributional reasons. Scaling alternative models of ownership also helps address some of the UK’s longstanding structural weaknesses, including productivity and inequality. This is because different models of ownership produce differing distributions of power and control within a firm, creating different purposes and outcomes within a business. While extraordinarily successful in some respects, the conventional company model has clear limitations, with a narrow focus on private, investor ownership which contributes to wider economic and social injustices in the contemporary UK political economy. New models of common ownership, that give individuals and communities a meaningful stake and say in their workplace and local economy, is a critical route to redressing these weaknesses and building a more productive, just and democratic economy. It is the most durable and effective way for people to ‘take back control’.

Our new report, Capital Gains, proposes three mechanisms that can help broaden the ownership of companies and spread economic rewards and power more widely. (We do not consider in this report the very specific sectoral questions arising from proposals to bring back into public ownership firms in fields such as railways, water and energy.)

First, we recommend the establishment of a Citizens’ Wealth Fund. Like other sovereign wealth funds around the world, this would own shares in companies, land and other assets on behalf of the public as a whole. It would thereby manage existing public assets and transform a part of national private and corporate wealth into shared public wealth. The Fund could be capitalised by a combination of capital receipts from the sale of public assets, revenues from a ‘scrip tax’ on corporate stocks, and the hypothecation of wealth taxes. The Fund’s investment mandate would be set by Parliament but it would be managed by an independent board on behalf of the public. The Fund would act to spread wealth by paying out a universal citizen’s dividend to all or particular groups of the population, and by investing in the provision of universal basic services. A forthcoming IPPR report sets out in greater detail how a Citizens’ Wealth Fund could be established, capitalised and governed in the interests of the people.

Second, we propose a series of measures to expand employee ownership trusts. Employee ownership trusts (EOTs) are a form of business model in which a majority of a company’s ownership is vested in its workforce. Such trusts enable a considerable share of the returns to capital (company profits) to be distributed to labour, and for workers to exercise a much more significant role in the governance of the firm. The trust creates a form of employee common ownership that provides the basis for employee participation in both profits and corporate governance, giving employees both distributional and control rights. The effect is to turn the traditional company ownership hierarchy on its head: whereas capital normally hires labour, in an EOT-owned company the employees hire capital.

A number of steps could incentivise the growth of EOTs, including stronger tax incentives for the transfer of business ownership and for external investment and measures to build individual capital stakes for employees. At the same time reform of pension auto-enrolment to increase minimum pension contributions would allow employers to credit company shares to their employees’ pension accounts. This would boost pension savings rates (which is urgently needed given the UK’s demographic trends), allow companies to use the working capital, and help transform the level of employee ownership in the UK. Indeed, we estimate that with these measures, the UK could create over 21,000 companies majority owned by their employees by 2030, with almost 3 million employee owners, a dramatic expansion of everyday common ownership.

Finally, we set out steps to scale the co-operative and mutual sector, which are democratically owned and governed. There are currently around 7,000 firms owned by their workers or consumers, with around 223,000 employees and a combined turnover of £35.7 billion. Strikingly, the five largest co-operatives paid 50 per cent more corporate tax than Amazon, Facebook, Apple, eBay and Starbucks in 2016. The number of co-operatives would be significantly increased if the financial, legal and infrastructure barriers currently facing them were addressed. Drawing on experience in other European countries with larger co-operative sectors, reforms should include establishing a Co-operative Capital Development Fund, financed by a levy on the profits of co-operative firms; a specialist Co-operative and Mutual Development Bank to finance co-operative enterprises; and the introduction of the same capital gains and inheritance tax incentives for companies at the point of sale to co-operatives as recommended for sales to employee ownership trusts.

Taken together, these models of common ownership – from the national to the firm level – can begin to reshape the ownership of economic assets and companies in society, distributing power and reward across the economy and society and producing differing distributions of power and control within the firm. Without such reforms capital’s growing share of income risks a world of spiralling inequality; with them, we have a chance to own the future.