Why the public debt should be treated as an asset

The Bank of England. Captain Roger Fenton / Flickr. Public domain.

The 20th century American comedian Rodney Dangerfield had a catchphrase: “I don’t get no respect”. The public debt is the Rodney Dangerfield of government finances. It is a long term benefit treated as perennial problem.

When we change our perspective on of the nature, size and ownership of the UK public debt we can see that it poses no threat to economic stability. Its size is modest and its burden on taxpayers is minor. If we treat the national debt as an asset, we can use it as a means to end austerity.

Give the public debt some respect and end austerity!

The claim that our public debt is excessive has been used as a major justification for austerity – cuts in spending. That massive debt, we are told, 1) must be repaid, 2) threatens our country with bankruptcy, and 3) is a burden on future generations. All these are wrong. Let me explain why.

When our government borrows it does so by selling a promise to pay, called a bond. For example, a household buys a £100 bond and our government promises to buy it back at the same amount in ten years with interest (at present 2.5% or £2.50 every year). A pound note also is a promise to pay (look at the small print near the Queen’s picture). A pound note is a bond paying zero interest.

Britain’s national currency is managed by our central bank, the Bank of England, owned by the citizens of the United Kingdom (that is, our elected government). As a result, the British government can never default on its bonds. Our government can replace maturing public bonds with new ones. Should private buyers, households and businesses, refuse to purchase the new bonds at the interest rate set by the British government, our government can sell them to the Bank of England. The option to sell to the Bank of England provides a fool-proof mechanism to prevent excessively high bond rates.

Whether the economy is strong or weak, the British government can never default on its debt. The debt is nothing more than pieces of paper that the government promises to buy back on a specific date. These pieces of paper can be bought back with new pieces of paper (new bonds) with later buy-back dates. If the private owners of the debt paper do not want the new bonds (new debt paper), our government can sell those new bonds to the Bank of England for cash and use the cash to pay the bond holders.

This buying and selling of public bonds is not the much-misunderstood Quantitative Easing (QE). QE was a one-way street – our government bought private corporate assets from companies threatened with bankruptcy. In a phrase, QE was “bail-outs” of reckless private sector financial behaviour.

The size of the public debt is not a problem

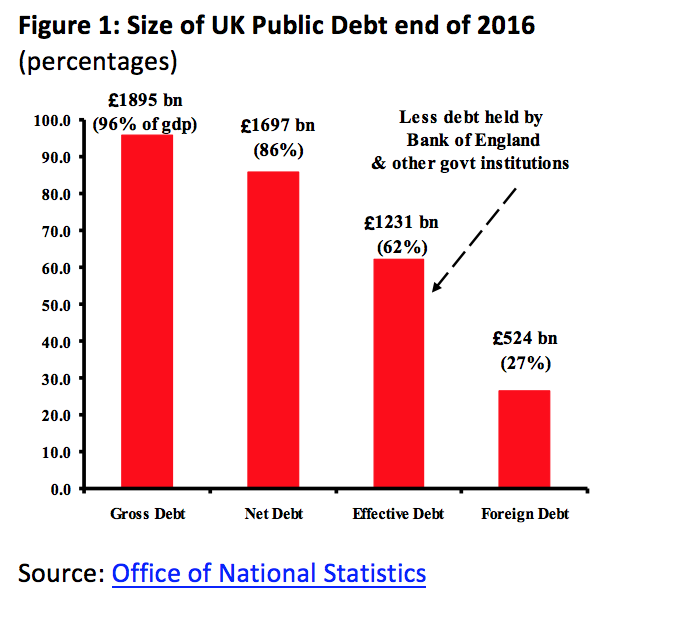

Figure 1 shows that outstanding public bonds (called “gilts” from the days when the edges of the bond had gold gilt) amounted to £1.9 trillion or 96% of GDP at the end of 2016, which was the UK gross debt.

When we look closer at the national debt, its nature changes. Public sector liquid assets (for example, cash deposits held by the central and local governments and financial assets such as stocks and bonds) reduced this to £1.7 trillion or 86% of GDP. When we subtract the government’s assets from its debt, we have the net debt, the measure of public indebtedness used by the Treasury. The gross/net distinction also applies to households. A household with a £300,000 mortgage and £50,000 in the bank has a net debt of £250,000.

Another 27% of the net debt amount (£466 billion) was held by public sector institutions, the vast majority by the Bank of England. This portion of the national debt is what the public sector owes itself. Subtracting this gives the effective debt, the debt that the UK government owes to others. In 2016, the effective debt was 62% of GDP.

The public debt is not a burden

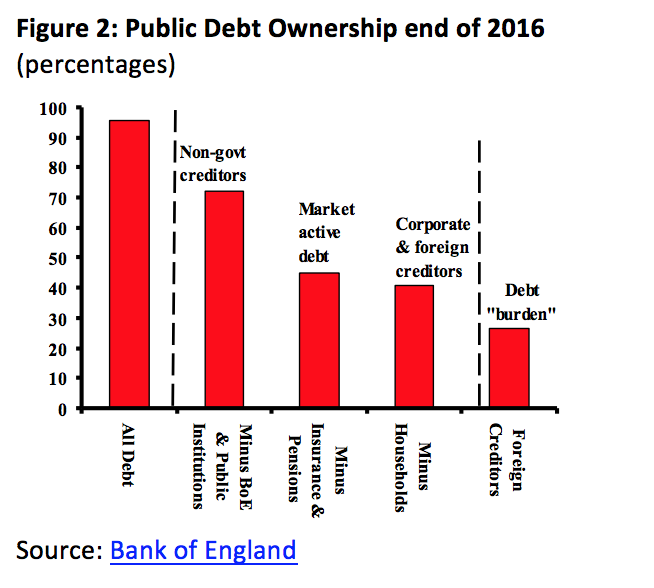

Who the government owes is an important factor determining whether the public debt is a burden. In the UK, the public sector itself owns 25% of the £1.9 trillion UK gross public debt (see Figure 2). The government pays the interest on this portion of the debt to itself. Thus, one-quarter of the debt and the interest paid on it are not a burden.

Pension funds hold a large portion of the 75% of gilts not owned by the government. The interest paid on debt held by pension funds is income to retired households. As such, this portion of the national debt is a source of household income, a benefit not a burden to citizens.

Debt held by the government itself and pension funds are long term holdings, rarely bought and sold. They do not represent a speculation danger that might put upward pressure on bond rates. When these are subtracted the remaining “gilts” constitute the market-active public debt, £808 billion, or 45% of GDP.

At the end of 2016, private corporate and foreign gilts holders owned 41% of the UK’s national debt. Only the £524 billion of gilts held by foreign creditors could be considered a “burden” in that the associated interest payments are from UK taxpayers to non-UK creditors. For fiscal year 2015/16 interest payments to foreign creditors were approximately £12 billion, or 0.6% of GDP – quite a small burden.

This analysis of the nature, size and ownership of the UK public debt shows that it poses no threat to economic stability. Its size is modest and its burden on taxpayers is minor. From this come the following policies to end austerity:

- Sound management of the national debt means more public borrowing for investment and current expenditure, which is justified by the modest size of the effective debt.

- The minor burden represented by foreign interest payments could be reduced by measures that would limit bond sales to domestic buyers (already applied in several other countries).

- Implementing a fair and progressive taxation system will ensure interest payments to domestic bond holders don’t have negative redistribution effects.

- Any speculative pressure on government bond interest rates can be prevented by selling bonds to the Bank of England.